Customer Services

Copyright © 2025 Desertcart Holdings Limited

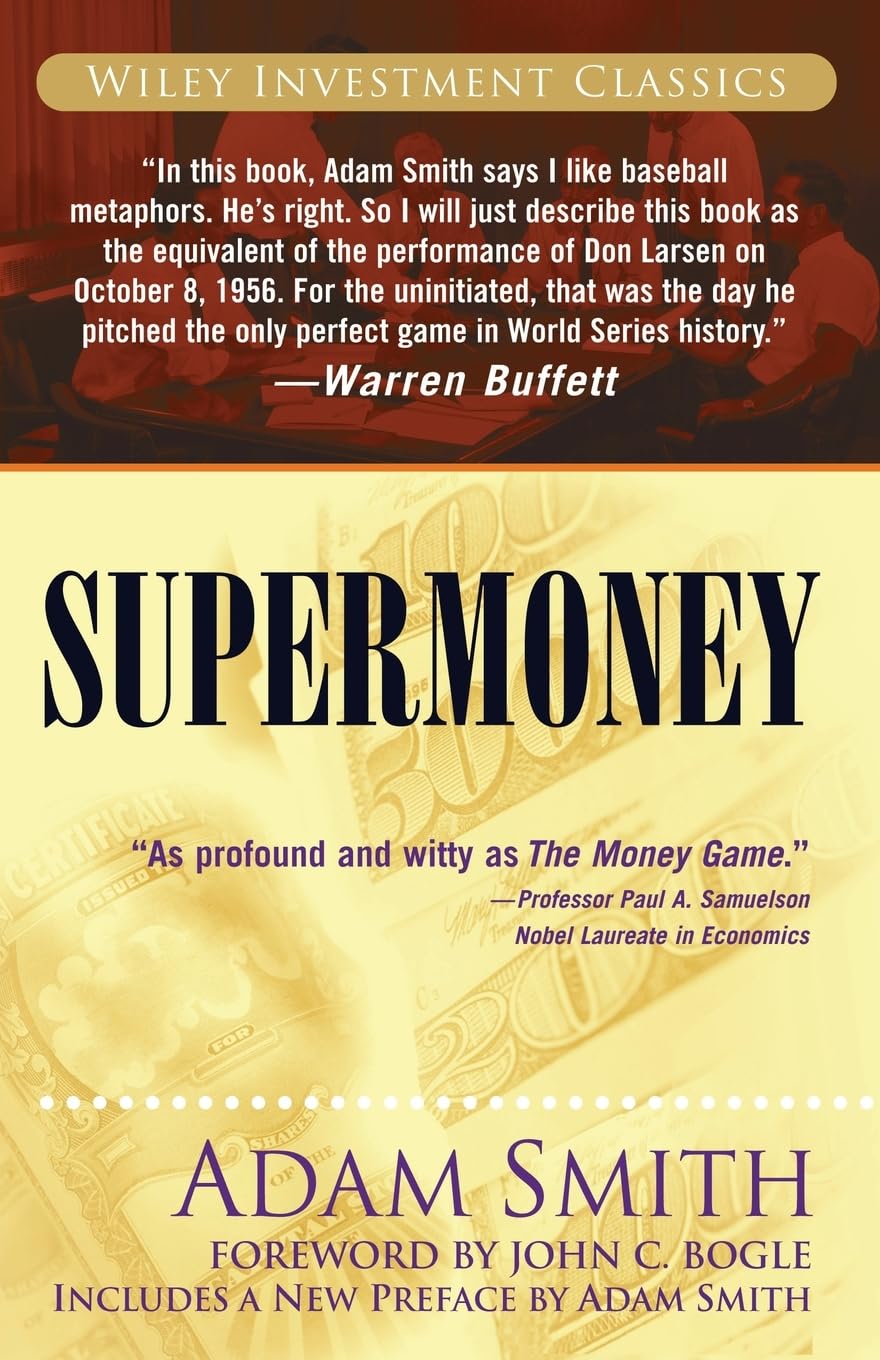

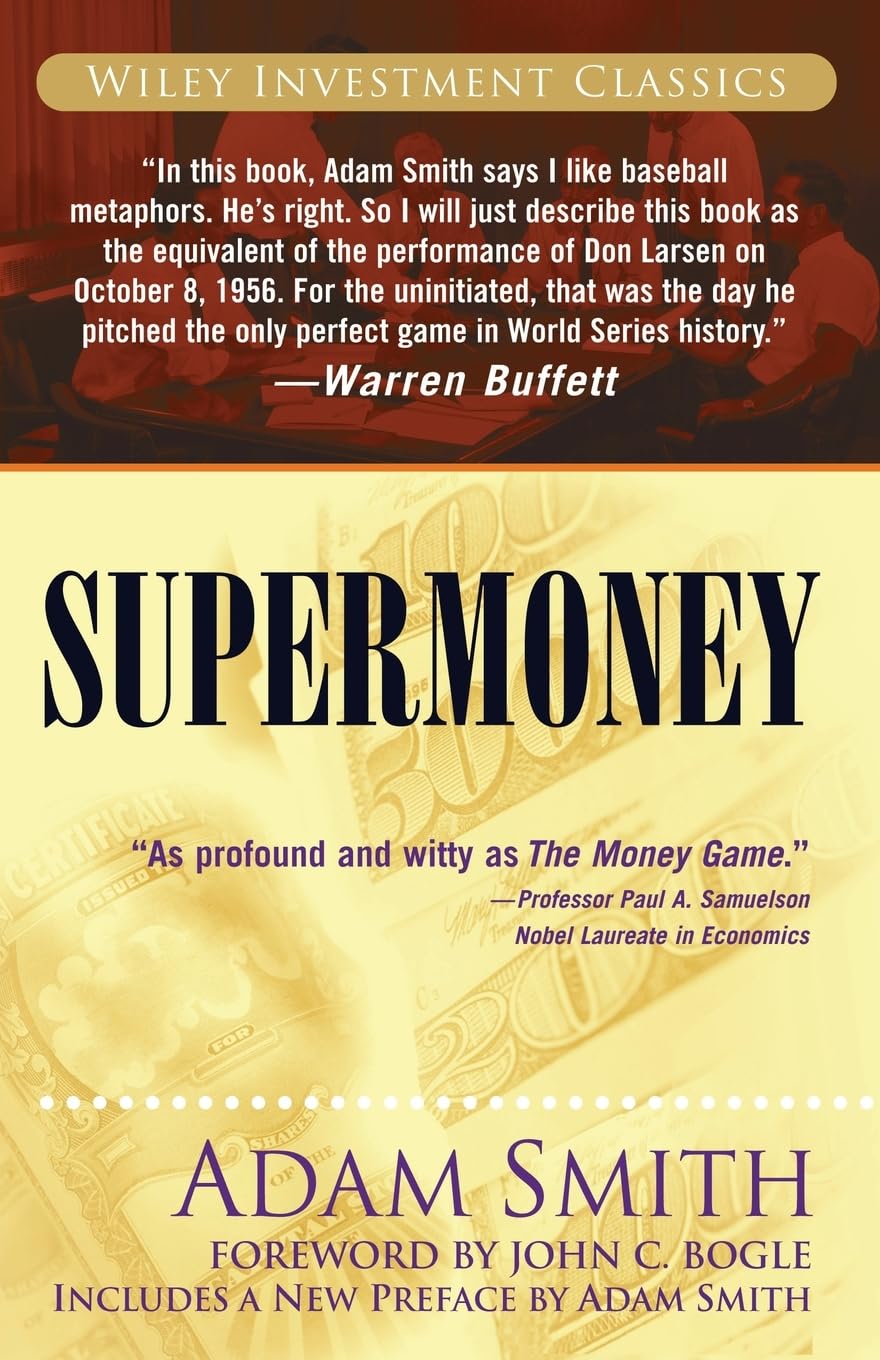

Supermoney by Adam Smith - Paperback : Smith, Adam, Bogle, John C.: desertcart.ae: Books Review: Interesante - Claro y consiso Review: An excellent tool for thinking about the sources of inequality - This book explains a lot about the sources of inequality. Just as banks loan out 10x the money that they take in from depositors, giving them enormous financial leverage, any public company - or even any company with a plausible hope of going public or being acquired at a high premium - is able to pay its employees in what this book calls Supermoney, valued sometimes at hundreds of times the value of the currency available to companies living purely in the ordinary world of exchanging goods and services. I wrote a long chapter on this topic in my own forthcoming book (entitled WTF: What's the Future and Why It's Up to Us.) While that's a big extension of what Adam Smith says here, and in many respects, this book is dated, it provides a fundamental tool for understanding the economy and what has gone wrong with it. Highly recommended.

| Best Sellers Rank | #172,796 in Books ( See Top 100 in Books ) #1,323 in Personal Finance #1,614 in Investing #2,007 in Finance |

| Customer Reviews | 4.4 out of 5 stars 100 Reviews |

C**N

Interesante

Claro y consiso

T**Y

An excellent tool for thinking about the sources of inequality

This book explains a lot about the sources of inequality. Just as banks loan out 10x the money that they take in from depositors, giving them enormous financial leverage, any public company - or even any company with a plausible hope of going public or being acquired at a high premium - is able to pay its employees in what this book calls Supermoney, valued sometimes at hundreds of times the value of the currency available to companies living purely in the ordinary world of exchanging goods and services. I wrote a long chapter on this topic in my own forthcoming book (entitled WTF: What's the Future and Why It's Up to Us.) While that's a big extension of what Adam Smith says here, and in many respects, this book is dated, it provides a fundamental tool for understanding the economy and what has gone wrong with it. Highly recommended.

B**N

First 2/3 was good.

I enjoyed the read, the first 1/3 in particular was enjoyable. Eventually Adam Smith must have got bored and just wanted to ramble whilst name dropping - last 1/3 was boring.

M**R

A book who times has passed

The copy is too old for today's investing. I found this less than interesting and not as humorous as implied

M**N

Incredible Book on Finance that Reads Like Stream of Consciousness

Adam Smith, who is really George Goodman, wrote this as a follow-up to the best-selling The Money Game (1968) (which were his first and second non-fiction books). The Money Game (1968) was a number one bestseller for over a year. "Adam Smith" introduced the catchphrase "Assume a can opener"* to mock the tendency of economists to make unjustified assumptions and asked, "Why are the economists almost always wrong?" Goodman was a member of the Editorial Board of The New York Times, an editor of Esquire Magazine, a writer for Fortune magazine, and a founding member of New York magazine where he worked with such writers as Tom Wolfe, Jimmy Breslin, and Gloria Steinem. If you have worked in the financial industry or love stock market history you will probably eat this up. If your interest in finance is on the practical side then you can safely give this a pass. It reads like Warren Buffett (who is frequently mentioned) is talking to you. I couldn't put it down. It is very hard to describe because it is a series of conversations, choices, and confrontations to the reader. We are eavesdropping on ideas about investing, Swiss bank accounts, money management, politics and much more. The book is not linear at all. It does explain and show the concept of "Super Money" which is really leveraged money very well. That idea is not nearly as transformational now as it was in the 1970's but here it is well-explained in a very compelling narrative. The more familiar you are with the behind the scenes world of finance the more you will appreciate the profound insights of the author. The wisdom of the message makes this book an absolute classic. * "Assume a can opener" is a catchphrase used to mock professionals, particularly economists, who base their conclusions on unrealistic or unlikely assumptions and tend to oversimplify problems. "A physicist, a chemist and an economist are stranded on an island, with nothing to eat. A can of soup washes ashore. The physicist says, 'Let's smash the can open with a rock.' The chemist says, 'Let's build a fire and heat the can first.' The economist says, 'Let's assume that we have a can-opener...'"

Trustpilot

2 weeks ago

1 month ago